How to Create a Subscription Revenue Model Template in 2025

You can create a subscription revenue model template for your SaaS business. Read through our latest guide to learn how you can go about the creation process.

This post was last updated on January 27, 2025.

Jump to read

What is a Subscription Revenue Model?

Benefits of a Subscription Revenue Model

How to Create Subscription Revenue Model Template for SaaS

FAQs

Summing Up

Managing a B2B SaaS(software as a service) business is tough. From accurately recognising revenue to ensuring there are no billing issues, there are a lot of challenges involved.

However, having a subscription revenue model template can help as it provides you with a structure and steers you in the right direction. It’s a framework that helps you navigate the complexities of revenue recognition and forecasting for a subscription business model.

Looking for a subscription revenue model template? Here we’ll discuss everything you need to know to craft a template yourself.

Trust us; it’s not rocket science. Anyone can create a subscription revenue model template with the right guidance.

Before we get into the details of how to create a subscription revenue model template, let’s clear some basics.

You May Also Like:

- Things to consider when establishing a subscription business

- Subscription Management solution tailored for SaaS

What is a Subscription Revenue Model?

With a subscription revenue model, SaaS businesses generate recurring revenue by charging customers at regular intervals for their products/services.

Here’s how the subscription revenue model works:

- A customer subscribes to a plan to use your product or services for a specific period, usually a month, quarter, or year.

- Instead of paying a one-time fee, they pay a recurring fee, which is charged periodically, depending on the plan.

- At the end of the subscription period, they either renew their subscription or cancel.

- As long as they continue their subscription, you will receive regular periodic payments—a steady revenue stream.

Here’s a simple illustration that explains the subscription revenue model.

The subscription revenue model is built to help enterprises establish long-term relationships with their customers.

This revenue model is popular and successful because it benefits both companies and customers. Companies enjoy revenue assurance and deeper relationships with their customers, allowing them to scale confidently.

Whereas the customers enjoy the convenience of auto-renewals and a higher value proposition. Additionally, it gives them flexibility with their subscription contracts.

Moreover, companies can offer products/services at a lower cost when they can save on customer acquisition costs.

How will you decide how much subscription fee you should charge and how you can forecast revenue?

Well, that’s where a subscription revenue model will come in handy. It provides a structured way for you to manage your subscriptions and recurring revenue.

If you’re not sure how to create a subscription revenue model template, we’re here to help.

Later in this guide, we will take you through the process of creating a subscription revenue model template with customer churn calculation. But first, let’s understand the benefits of using a subscription revenue model for your business.

You May Also Like:

- An Introduction to Subscription Management for B2B SaaS Companies

- What is Subscription Management? A Guide for SaaS Businesses

Benefits of a Subscription Revenue Model

Before you start creating a subscription revenue model template, you must first decide if using a subscription model is good for your business.

Here, we’ve listed the benefits of using a subscription revenue model to help make the decision easier for you. So, read on and then decide if it’s the right revenue model for your business.

1. Creates a Steady Revenue Stream

The biggest benefit of a subscription revenue model is that you get a steady and consistent revenue stream.

Customers will pay a fixed subscription fee monthly, quarterly, or annually. If you use a good subscription management platform, then invoicing and payments management would be a breeze.

This means you will get a consistent revenue stream, every period, avoiding cash flow challenges.

With a steady revenue stream, you can easily plan a business expansion or other major business expenses.

A subscription revenue model template can help make this easier.

You May Also Like:

- How Subscription Management Increases Your Revenue

- Essential Subscription Revenue Recognition Strategies

2. Helps Reduce Customer Acquisition Costs

Acquiring new customers is a long and costly process, especially for B2B businesses. You need to spend on numerous marketing initiatives to reach the right decision-makers and encourage them to become customers.

Retaining customers who have already trusted your company once is much easier.

With a subscription revenue model, retaining customers and encouraging ongoing patronage is easy. You simply need to offer better deals on long-term subscriptions and you’ll solve your customer retention challenge.

Since this model works largely on getting repeat business from customers, you don’t need to spend as much time and effort on customer acquisition as traditional businesses do.

3. Is Convenient for Customers

Another reason to choose a subscription revenue model is that it’s convenient for your customers.

Most subscription businesses offer multiple pricing plans with different features or usage limits. This allows customers to choose a subscription plan that best suits their needs and pay only for the features or services they want.

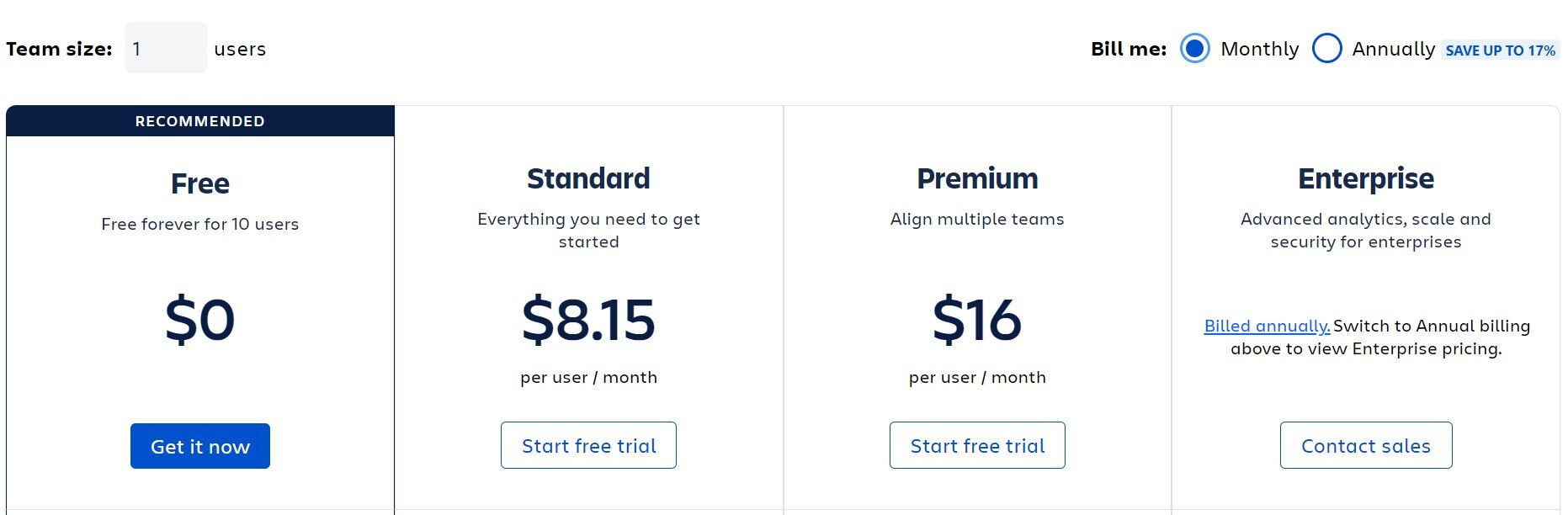

Asana, for instance, offers five different plans catering to all types of clients from small businesses to large enterprises.

Image via Asana

Additionally, customers can negotiate contracts and choose payment schedules that meet their needs. If they don’t want the hassle of monthly payments, for instance, they can choose to pay annually.

4. Builds Strong Customer Relationships and Fosters Retention

With a subscription revenue model, you can retain customers longer, as previously discussed.

This gives you more time to win them over and satisfy them with exceptional product or service experience.

Let’s say a customer gets an annual subscription to your platform. This is enough time for them to get used to the interface and learn how to use the platform’s features to their full potential.

During the course of their subscription, they may face some challenges, which gives your support team a chance to provide quick support and a great service experience.

All of this contributes to brand loyalty and gives you a chance to build strong customer relationships. Anyone who’s satisfied with your service will be hesitant to leave simply because of a better deal.

You May Also Like:

- Why prioritising customer experience can improve USPs

- How to create more personalised experiences for customers

5. Boosts Customer Lifetime Value

Many subscription businesses retain customers longer by offering better deals on long-term plans. This could be in the form of a discount or any other offer.

Some go as far as offering only an annual plan, to ensure that each new customer sticks around for at least that long.

Jira, for example, offers up to 17% discount on its annual subscriptions. Moreover, its Enterprise plan is only available with an annual contract and does not allow monthly billing.

Image via Atlassian

Another strategy that subscription businesses often employ to retain customers longer is offering incremental renewal offers. This involves offering higher discount rates or deals as the subscription end date for a customer approaches.

This helps improve subscription renewal rates and boost Customer Lifetime Value in the process, which is one of the SaaS KPIs that matter a lot.

Here’s an example of incremental renewal offers.

Why does this matter?

Well, the simple answer is that these tactics ensure your customers stay for at least a year, and preferably more, which increases your customer lifetime value.

With a traditional business model, you’d have to put in a lot more effort to encourage repeat business and improve your CLV. However, with a subscription revenue model, it’s much easier.

You May Also Like:

- The All-Inclusive Guide to B2B SaaS Subscription Metrics

- Key SaaS metrics you need to grow your business in 2024

6. Makes Financial Forecasting Easier

One obvious benefit of using the subscription revenue model for your business is that it gives you a predictable revenue stream.

Based on your existing customers and their subscription plans, and the average churn rate expected within a period, you can accurately forecast your subscription revenue.

This helps you plan your future business expenses and ensures you have a healthy cash flow.

Using a good subscription management platform like Younium can make this process even easier. It provides you with tons of subscription metrics that you can use for revenue forecasting.

You May Also Like:

- How Efficient Subscription Management Enables Accurate Revenue Forecasting

- Forecasting Subscription Revenue: How to Do It Right

7. Offers Upselling Opportunities

When you use a subscription revenue model, you can offer customisable plans to your customers with paid add-ons.

This allows them to choose the specific additional services they want, apart from what’s available on the subscription plan, which is convenient for them.

More importantly, it allows you to upsell to existing customers by offering valuable add-ons that complement their existing plans.

Also, customers can start with a basic plan and upgrade to higher-tier plans as their needs grow. This offers an automatic upselling opportunity, without much effort required from your side.

Take Zapier, for instance. It employs a usage-based pricing model where the price for plans increases with the number of automation tasks a customer performs.

Image via Zapier

The financial model ensures that businesses that have more automation requirements pay more than those with basic requirements. That’s upselling on autopilot for you!

You May Also Like:

How to Create Subscription Revenue Model Template for SaaS

The rise of SaaS businesses has triggered the growth of subscription revenue models in the B2B environment.

However, creating a subscription revenue model template for SaaS businesses requires you to forecast cash flow and customer acquisitions.

In this section, we will guide you through the process of creating a subscription revenue model template for your business. Here are the key steps involved in the process.

1. Forecast Customer Acquisition

Forecasting the number of customers you might get is crucial for building a subscription revenue model template. You can start by putting the expected number of subscribers for every month in a spreadsheet.

You can even break down the subscribers’ monthly count into the following categories in your subscription revenue model template:

- Retained Customers: Customers who renew their contract and will continue to avail of your services.

- New Customers: Acquired customers in a given period.

- Churned Customers: Customers who terminate or don’t renew their contracts and stop using your services.

- Upgrades/Downgrades: Subscribers who have switched among your paid plans (assuming that your subscription pricing plans have more than one option).

In your subscription revenue model template, you should also include customers using the free version of your services and not just the versions you’re monetising.

Moreover, if your subscription model offers different pricing plans, you can split your customer acquisition column to include all of them.

2. Forecast Customer Churn

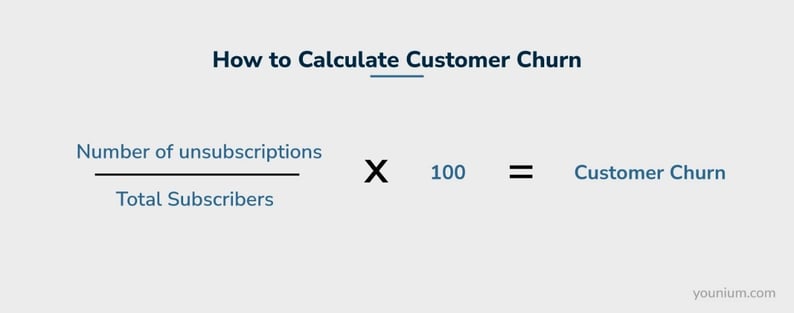

In order to calculate the correct value of total customers every month, you need to forecast the customer churn along with the new customer acquisition rate.

Customer churn rate measures the number of customers who have stopped doing business with you and stopped using your services.

To calculate your customer churn rate, just sum up the number of users that unsubscribed in a given period and divide that figure by the total number of users in that particular period. Multiply the result with 100 to get the customer churn rate.

To ensure the success of your subscription revenue model, you can track customer behaviour using the following B2B SaaS subscription metrics:

- Inactive Users to Unsubscribers Rate: You can include those users who haven’t availed of your services during the given period.

- Monthly Churn Rate: The percentage of customers that churned for a given month.

- Sign-Up Retention Rate: Calculated as the number of customers that stayed or renewed their subscription after their sign-up or trial period.

Although these three subscription metrics correspond to customer behaviour, you have to track them separately in your subscription revenue model template.

The pre and post-sign-up behaviour differ in intensity, whereas inactive user count is very useful for predicting customer churn.

With ample customer behaviour data, you can calculate inactive users to unsubscribers' rates and other intelligent indicators that can help you develop a foolproof subscription revenue model template.

You May Also Like:

- How to reduce churn (with subscription billing & AI-powered customer success)

- Reducing Churn: AI Customer Success Meets Subscription Billing

3. Forecast Subscription Revenue

Not every user is a paying customer. And given that you offer several pricing contracts, it isn’t possible to calculate or predict total revenue in your subscription revenue model template by just multiplying the subscription rates with the total customer count.

You need to categorise your customers as per their subscription plans and then multiply their counts with their related subscription fees to forecast subscription revenue.

If you’re planning to reduce your subscription prices in the future or modify your offerings on them, include that in your template by putting a separate column for discounts and subtracting it from the subscription rates.

This would help you figure out the potential monthly recurring revenue and annual recurring revenue from the paying customers.

Here are some types of monthly and annual recurring revenue metrics you can calculate for your subscription business model.

Image via Younium

4. Include Direct Customer Costs

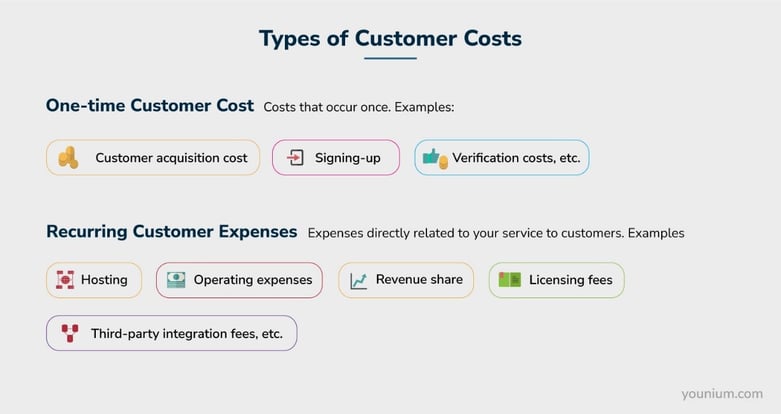

You need to include your expenses in the subscription revenue model template.

The customer cost and acquisition cost calculation should be linked to the subscriber prediction and reflect the cost of providing them with the services.

You can divide the customer expenses into two sections in the subscription revenue model template:

One-time Customer Cost: Costs that occur once, like customer acquisition cost, signing-up, and verification costs.

Recurring Customer Expenses: Here, you need to include the expenses directly related to your service to customers like hosting, operating expenses, revenue share, licensing fees, third-party integration fees, etc.

The recurring costs can be further divided into fixed and per-customer expenses.

You’d need help from your finance team to get this step right. They can calculate the direct customer costs and further break them down into fixed and variable ones.

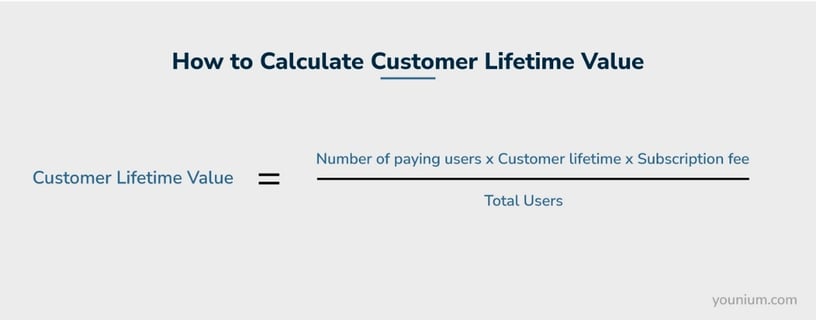

5. Calculate Customer Lifetime Value

With all the data you’ve gathered for your subscription revenue model, it is now easy for you to calculate the customer lifetime value (CLV), one of the most important SaaS metrics.

You can use the customer churn and financial business models to calculate how much an average user will contribute to your cash flow.

If it sounds complex to you, here is how you can calculate your customer lifetime value in your subscription revenue model template:

- Calculate customer lifetime using post-sign-up retention rate and monthly churn. For instance, if your post-sign-up retention rate is 80% and monthly churn is 10% this is how you can calculate your customer lifetime:

0.80 ÷ 0.10 = 8 Months

For this hypothetical situation, the customer lifetime is eight months. The sign-up retention rate is considered for the first month, whereas only the customer churn rate is enough for the rest of the period. - Calculate gross customer lifetime value by multiplying the customer lifetime with relevant subscription fees. Assuming that the organisation didn’t charge any fee for the first month (the trial period), the gross customer lifetime value will be calculated for 7 months.

For the previous hypothetical situation the gross customer lifetime value is: [(80 users) x (7 months) x ($200 monthly subscription fees)] / 100 (total users) = $1120

- Reduce direct customer cost (per user) from the gross customer lifetime value to get the net value.

6. Add General Expenditures

You can also include general and operating expense forecasts to make your subscription revenue model template more intelligent.

Get the expenditure information from your cash flow and income statement showcased in your financial projections.

This will include employer-elated costs, administrative expenses, and other operation costs for your subscription business.

7. Summarise Your Subscription Revenue Model

You’ll be continuously using and adding information to your subscription revenue model template.

Hence, it’s important to include a summary where you can compare your current month's revenue stream with your projections.

Also, don’t forget to add insightful graphs to the subscription revenue model template, summarizing your financial plans for the upcoming months.

That brings us to the end of this guide on how to create a subscription revenue model template.

You May Also Like:

- How to Streamline Financial Processes with Subscription Billing Platforms

- What is Subscription Billing? A Guide for SaaS Businesses

FAQs

1. What is the formula for the revenue of a subscription-based SaaS business?To calculate net revenue in a subscription-based revenue model every month, you can use the following formula:

[(Customers subscribing to your services) x (Subscription fee of every customer)] - Total direct customer cost

To calculate the annual revenue, you can multiply the above by 12.

2. How does a B2B subscription revenue model function?Generally, B2B subscription revenue models are based on customers subscribing to your services for a recurring cost every month/year. They get to use your product or services for a specified period and pay for it either monthly, quarterly, or annually.

However, the functionality of a subscription revenue model in a B2B environment depends on the contract the business signs with its customers.

Customers can negotiate and select the features or services they want, their payment schedule, and other terms. There are numerous pricing strategies B2B subscription businesses can employ including tiered pricing, usage-based pricing, and custom pricing.

3. What is a subscription revenue model template?A subscription revenue model template helps you navigate the complexities of managing a subscription business.

From predicting customer acquisition and churn to calculating business expenses, there’s a lot you need to do when you run a subscription business. Since it doesn’t work like a traditional business, calculating costs and forecasting revenue is tricky.

A subscription revenue model template provides you with a structured framework to navigate these complexities and better manage your business, which helps in higher revenue generation.

4. What are the three essential steps critical in developing a subscription-based revenue model?The three most crucial elements of every subscription-based revenue model are:

- Forecasting customer acquisition and churn

- Calculating direct customer costs, including discounts

- Calculating customer lifetime value

Use a subscription revenue model template to successfully establish and manage a subscription business. A template will give you a clear strategic direction and streamline the process.

5. How do you forecast subscription revenue?

Forecasting subscription revenue is not rocket science.

Here are the steps you can follow to forecast revenue for your subscription-based revenue model:

- Forecast customer acquisition

- Forecast customer churn

- Forecast subscription revenue

- Include direct customer costs in your revenue model template

- Calculate the customer lifetime value

- Summarise your subscription revenue model

Here is a step-by-step process you can follow to build a business with a subscription revenue model:

- First, do some research and find out if a subscription revenue model is fit for your business.

- Make a business plan for your new subscription business.

- Choose the right pricing and revenue strategy for your product or services and create the various subscription plans you’ll offer.

- Use marketing efforts and lead-generation tactics to acquire new customers.

- Offer incentives to encourage customers to opt for long-term subscriptions.

- Deliver exceptional user experience to retain customers and improve your CLV.

Follow these to start and run a successful B2B subscription business. Make sure you use a subscription revenue model template to further ease the process.

7. Is the subscription revenue model profitable?Just like any other business, subscription businesses also have varying odds of success or failure. There is no guarantee that if you choose a subscription revenue model, it will be profitable.

However, a subscription revenue model offers some inherent advantages that make it a better bet than traditional business models.

First, it ensures a steady revenue stream by allowing you to collect recurring revenue for your product or service. This improves your cash flow situation, giving you an advantage over traditional businesses that often face cash flow problems in the early stages.

Second, the customer acquisition costs are comparatively low and CLV is generally high for subscription businesses. This means you will likely be able to retain customers longer and gain more repeat business than traditional businesses. This further boosts profitability for your subscription business.

You May Also Like:

- How B2B SaaS Finance Teams Can Use Technology to Their Advantage

- How to Cut Tedious Tasks and Seize a Strategic Finance Seat

Summing Up

Managing a subscription-based SaaS business isn’t a cakewalk. You need to put financial and marketing brains together to roll out the best subscription revenue models.

In this post, we’ve discussed how to create a subscription revenue model template.

But, if you need help in managing your entire cycle of B2B customer subscriptions without managing a template, feel free to contact Younium.

You can book a free demo of our platform and embark on your SaaS journey while ensuring that you’ve got all the metrics under your watch.