Revenue Growth Management: What Is It and Why It’s Important

Learn about revenue growth management (RGM), its importance for businesses, and how it can drive sustainable growth. Explore key components and best practices.

Jump to read

The basics: What is Revenue Growth Management?

Key Components of Revenue Growth Management

Implementing Revenue Growth Management Strategies

Benefits and Challenges of Revenue Growth Management

FAQ

Conclusion

Every business, including subscription based platforms, needs to scale up to reach new heights. But this growth shouldn’t be haphazard. Instead, it requires a carefully planned approach called Revenue Growth Management (RGM) to achieve sustainable growth.

As a SaaS business, you rely on your existing customers to continue paying for the services you render. This, combined with acquiring new customers, is the path to sustained revenue and profit growth for your SaaS.

So, what exactly is revenue growth management, and how can you leverage it to help scale your SaaS business performance? Also, how can a revenue growth management software platform help you?

Let’s find out.

The Basics: What is Revenue Growth Management?

In simple terms, Revenue Growth Management is the process of driving sustainable and profitable growth of your SaaS business by increasing your customer base, optimising pricing, finances, marketing, and sales. You do this through a range of customer acquisition and retention strategies by using the right software platform for it.

But guess what?

Revenue Growth Management isn’t a new concept either. In fact, it’s been around for quite some time now and primarily focused on pricing strategy to get more customers to stick with the SaaS or attract new ones.

But now, it’s a more holistic approach to growing revenues by incorporating other elements like product variations, incentives, and more. And revenue growth management software platforms like Younium can help you with it all.

In fact, a global consumer-packaged goods (CPG) firm whose business performance struggled because of failing to adapt to changing market conditions could grow its revenue and realise millions of dollars in profits, solely through the adoption of Revenue Growth Management.

Historical Context

As a concept, Revenue Growth Management started nearly five decades ago. It was used then by the airline industry for optimizing the occupancy levels of flights. Eventually, the hotel industry began using these strategies for optimizing their occupancy levels.

The reason for this was simple—their main offerings had similarities:

- Limited capacity

- Perishability (seat or hotel room that goes empty for a day can’t be compensated)

- Need for segmentation based on prices (types of rooms or seats)

And given that demand fluctuations are a reality for both these industries, employing such revenue growth management strategies can help bring in consistent revenue streams.

Over the years, other industries, especially CPG companies (Consumer Packaged Goods), have adopted this tactic. Many businesses have recognised that revenue growth management is essential for maximising profitability and ensuring sustainable expansion. But B2B SaaS businesses have also been quick to adopt this strategy to boost their revenues.

Objectives of Revenue Growth Management

By now, you might be wondering about the applications of revenue growth management—what are the real goals behind this strategy?

Well, some of the main goals of employing RGM are:

- Optimising sales channels to drive greater revenue from them.

- Improved revenue recognition and better B2B subscription management and billing to drive revenue growth.

- Reducing churn so the MRR (Monthly Recurring Revenue) and ARR (Annual Recurring Revenue) of your SaaS grow regularly.

- Eliminating any roadblocks in acquiring new customers for your SaaS.

- Increasing customer loyalty by improving the user experience.

- Maximising profitability by reducing expenses and increasing revenues.

What is Revenue Growth Management Software?

Revenue growth management (RGM) software is a data-driven solution that's designed to help you optimise your pricing, finances, promotions, and product strategies to maximise revenue and profitability. It’s a platform that helps you acquire new customers, prevent existing customers from churning, scale your financial operations, among other things.

Such a software platform leverages advanced analytics, historical sales data, and market insights to help you make informed decisions. Effective revenue growth management relies on these insights to enhance transparent and flexible pricing models and drive long-term profitability.

And how exactly does it do that?

It does so by helping you analyse pricing models, automate financial operations, giving you detailed insights into subscription metrics, revenue figures, and more. The platform also helps you with forecasting so you can determine if your strategies will translate to results in the future. Revenue growth management tools ensure that businesses can fine-tune their pricing and promotional strategies based on data-backed decisions.

Additionally, it could come with other features. For instance, Younium comes with features like accurate subscription revenue recognition features and multi-currency support. This helps you get greater clarity into your financial performance and enables you to scale them as your subscription business grows.

When SaaS businesses implement a revenue growth management strategy with the right software, they can maximise their earning potential and stay ahead in competitive markets.

Key Components of Revenue Growth Management

In itself, Revenue Growth Management is a complex framework that has loads of moving parts. Here are the three major components that make it up.

Pricing Strategy

Pricing is an important factor for both your subscription business and customers alike. It could prove to be a dealbreaker for many customers when making a purchase decision. At the same time, pricing can play a huge role in the profitability of your subscription business as it can impact your revenues.

What’s more?

Through pricing, you can also determine who exactly can be your customer. Price your service too high and it’ll likely only be accessible to enterprises. On the other hand, if you have a range of pricing options, you’ll have a whole bouquet of prospective customers ranging from new brands to enterprises. This is where revenue growth management comes into play. By strategically aligning pricing with market demand and customer segmentation, you can ensure sustainable growth.

And it’s due to these reasons that your pricing framework has to be optimised. Using AI (artificial intelligence) and ML (machine learning) models paired with existing data on your customer base, you can determine which packages are likely to bring in more customers or help you retain existing ones.

For instance, given that 65% of companies globally are already using gen AI in their businesses, it’s essential that you start doing so, too.

Image via McKinsey

Some of the other things that you can do are:

- Analyze the data to find out the reasons behind customers leaving your SaaS platform. Fix those pricing issues to stop the outflow of customers.

- Find out which pricing structures work better for you. Would tiered pricing be better or custom? The answer to this lies in the analysis.

- Figure out what sort of freebies result in better conversions among freemium, free demo, and free trials.

- Understand how discounts help increase customer acquisition and retention.

- Use a solution like Younium to automate SaaS billing and improve the quality of your subscription and revenue data.

Case in point—a North American industrial camera company started leveraging pricing optimisation to boost their revenues. Using revenue growth management principles data-driven insights and mapping price versus value, they registered a 79% increase in revenue in their core segment and 21% growth in their enterprise segment.

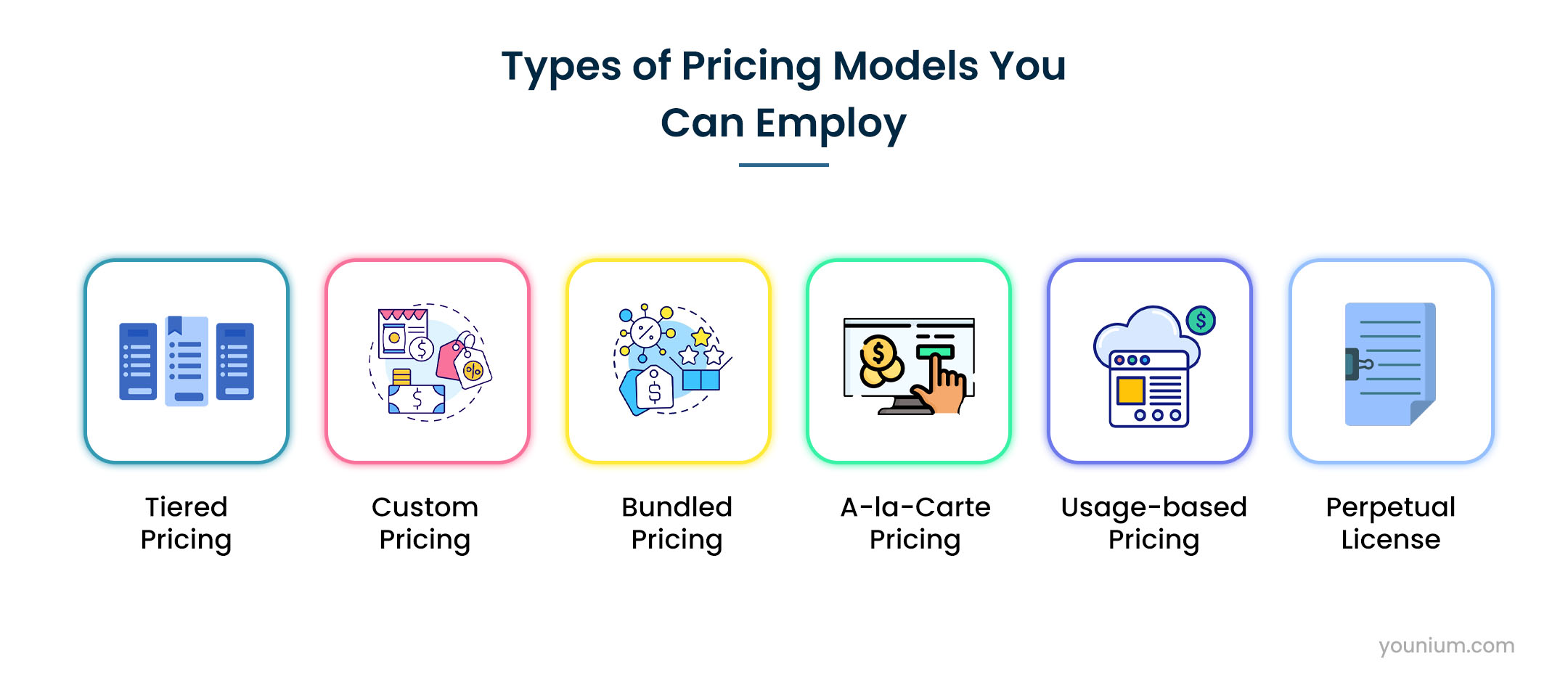

Types of Pricing Models You Can Employ

Here are some pricing models you can consider for your subscription business.

- Tiered Pricing: This pricing model employs multiple pricing tiers for the customers so they can choose the plan that best fits their requirements and budget. It is a common pricing model for revenue growth management, as it allows businesses to maximise customer value at different price points.

- Custom Pricing: Here, the pricing isn’t fixed. Instead, the pricing depends on the customer’s requirements. Based on the features they choose to opt for, the pricing will change.

- Bundled Pricing: In these types of plans, features are bundled into a single package. This means the customer only has to pay for the bundle and not individual features. It gives them numerous options at a competitive price.

- A-la-Carte Pricing: Bundled pricing has a major con—customers pay for features they may not want. With this pricing model, they get to choose the exact features they need and pay only for those.

- Usage-based Pricing: In this pricing model, the users are charged based on their usage. This usage could be in terms of hours, number of instances, etc. This flexibility is key in revenue growth management, as it ensures businesses can meet customer demands while maintaining profitability.

- Per-user Pricing: This pricing model is particularly built for businesses, and you charge a fixed fee for each user who uses the platform. It enables businesses to use your SaaS at scale and you benefit from it too.

- Perpetual License: This is the simplest pricing model where the customer pays a one-time fee to access your SaaS and keeps it for life. It’s equivalent to buying it.

You could also use a mix of pricing models and leverage Younium to track your revenue and subscriptions with those. The reason here is that tracking revenue for these pricing models is difficult due to the unique terms, timing, and contractual arrangements for each. Younium can help you track revenues from complex models to help you understand which ones work the best for your business.

How Revenue Growth Management Software Helps with Pricing Optimisation

Here’s how you can use revenue growth management software to improve your revenue by modifying your pricing plans.

- Price Elasticity Analysis: Tools for revenue growth management can calculate price elasticity, which measures how sensitive customer demand is to changes in price. Understanding price elasticity helps you determine the optimal pricing strategy, such as whether to raise or lower prices and by how much.

- Pricing Model Analysis: Revenue growth management software like Younium that’s purpose-built for subscription businesses can help you try out various pricing models. These include one-off, recurring, usage-based pricing, and more. By testing them out, you can figure out which one improves your revenue prospects the most. The built-in analytics features on Younium can help you identify the right model.

- Automated Billing: Billing mistakes can prove to be costly and lead to loss of revenue. By automating the billing process with revenue growth management software, you can ensure that your clients pay the right amount. It also minimizes the chances of revenue leakage, which could otherwise prove to be quite costly. Younium even offers flexible billing rules so you can truly automate it.

- Competitive Pricing Insights: Using revenue growth management tools can provide in-depth insights into competitor pricing trends, helping businesses make data-driven pricing decisions. By monitoring industry benchmarks and adjusting pricing strategies accordingly, companies can stay competitive while driving sustainable revenue growth.

Scaling Financial Operations

Financial operations form the backbone of any subscription business. And that’s why it’s essential to make them scalable. This way, as your business grows, your financial operations will be able to keep pace with your growth and support it too. It’ll enable you to seamlessly grow your customer base, manage the larger client roster, and ensure your revenue increases in the process.

Here’s how you can do Revenue Growth Management through financial operations and how RGM software platforms can help you with it.

Revenue Recognition

Proper revenue recognition ensures that revenue is recorded accurately in financial statements. Revenue growth management software like Younium help automate and streamline financial processes, reducing the risk of revenue leakage or misreporting.

Younium automates revenue recognition, ensuring compliance with ASC 606 and IFRS 15 standards. This serves as an audit proof and enables your auditors to easily navigate your system and verify your compliance. When your revenue is recognised at the right time, it aligns financials with actual performance, aiding in effective revenue growth management.

Invoice Automation

Younium’s invoice automation tools streamline the invoicing process, reducing errors and delays. Timely and accurate invoicing improves cash flow management, shortens the payment cycle, and enhances customer satisfaction, ultimately boosting revenue for SaaS success.

Additionally, Younium automates settlements for you and registers payments against invoices it has sent if you’re running AR in it. These entries are placed in segmented journals for ease of accounting too.

Subscription Management and Recurring Billing

Effective subscription management is crucial for scaling SaaS businesses. And that’s why your revenue growth management software platform has to offer features related to it. From terms to customisations and billing schedules,

Younium can help you manage your subscriptions with ease. Additionally, it takes care of recurring subscription billing by sending timely reminders to customers, preventing churn and driving growth.

Multi-Currency Billing

In a global economy, subscription businesses often have to transact in multiple currencies. Revenue growth management software with multi-currency billing capabilities simplifies international transactions, enabling you to expand into new markets with ease, leading to revenue growth.

With Younium, you don’t just get support for multiple currencies, but also for multiple entities. This way, you can get a detailed insight into the overall financial health and performance of your group of companies.

Revenue Forecasting

Accurate revenue forecasting is crucial for planning and decision-making. By accurately figuring out if a certain strategy can bring in the desired results, you can put more impetus behind it.

Revenue growth management software uses historical data, market trends, and demand forecasts to provide insights into future revenue streams. This enables you to allocate resources effectively and identify growth opportunities.

With Younium, you get detailed insights into your subscription data. From revenue and subscription metrics to booking metrics, you can track them all.

Product Optimisation

At the end of the day, your product is the thing that gets people to pay for your SaaS. And that’s why a key component of a Revenue Growth Management software platform is product optimisation. This involves improving your product to attract and retain customers.

By adapting your product to new SaaS trends, you make it more attractive for your customers. Effective revenue growth management ensures that product enhancements directly contribute to increased revenue and customer satisfaction.

Some of the things that can add up to product optimisation include:

Product Features

Creating a solid subscription product requires you to consistently keep adding new features to it. With each new feature introduced to your product, you make it more attractive for your customers.

You can use the new features to market your product to prospects and existing customers alike. New features also help your customers get more value for their money and keep them hooked to your SaaS.

Product Integrations

One of the deal breakers for SaaS platforms are their integrations. Your customers may have a tech stack in place and it’d be a pity if your SaaS doesn’t integrate with the other tools they use.

That’s why it’s essential to have integrations that can help customers improve their workflow. You can look at your target audience and determine which integrations might be the most important for them. For revenue growth management, seamless integrations are crucial for reducing friction and maximising customer lifetime value.

Case in point—Younium offers numerous integrations with leading platforms like HubSpot, Stripe, QuickBooks, Salesforce, and Microsoft Dynamics 365, among others. This helps you build seamless financial workflows to help scale your revenue.

Younium also offers a well-documented public API that you can use to create custom integrations with your tech stack.

Product Pricing

As mentioned earlier, the way you price your products can make or break your revenue growth. You can launch various pricing models for your products and then analyse their impact to figure out which strategies help you grow your business revenue the best.

These are the ones that you can double down on to give your business a boost. Keep doing this consistently to give your SaaS a solid growth.

Ease of Use

Needless to say, ease of use is an important factor in the revenue growth management strategy to ensure your growth. The ease with which your customers can use your products can play an important role in helping you grow your revenue. A user-friendly product will likely help you retain a lot of your customers. Additionally, it’s a strong marketing point that you can use to attract new customers to your business.

At the same time, if your product doesn’t offer a great user experience, your customers will likely leave your SaaS and head to your competitors. Needless to say, ease of use is an important factor in the RGM strategy to ensure your growth.

Devices

One of the factors that goes into deciding whether a SaaS platform would be useful for a customer is the devices on which it’s available. Your SaaS could be available as a web app, desktop app, or even a smartphone app. So, make sure your SaaS can be used on all major operating systems on these devices.

How Revenue Growth Management Software Helps with Product Optimisation

Apart from integrating with other tools in your tech stack, Revenue Growth Management software platforms also help with product optimisation in the following ways:

- Feature Testing: You can easily measure the impact of new features on your revenues using the platform. By tracking SaaS metrics like MRR and ARR, you can find out if product changes are positive or negative.

- Device Testing: Your Revenue Management software platform can help you determine if there was an uptick in subscriptions by making your products available on new devices.

- Usage-based Charging: If you introduce a new feature that’s charged by usage, your Revenue Growth Management platform can help you measure the revenue from that as well to help with product optimisation.

Sales Channel Management

Just the way marketing optimisation plays an important role in Revenue Growth Management, you also need to focus on sales channel management. By looking at the sales strategies and channels you use, you can optimise them for better results.

But why do sales channels matter when it comes to Revenue Growth Management?

Why Sales Channels Matter

1. Diversified Revenue StreamsOne of the primary advantages of managing sales channels is that they help diversify your revenue streams.

Relying on a single sales channel can make your business vulnerable to market fluctuations or disruptions. Instead, by carefully selecting and optimising multiple channels, you can reduce risks and ensure a steady flow and growth of revenue.

2. Targeting Different Customer SegmentsDifferent sales channels might attract distinct customer segments. Effective sales channel management allows you to tailor your marketing strategies and product offerings to cater to these diverse customer groups. In fact, you can even tie these strategies together to drive omnichannel sales.

3. Geographic ExpansionIf you're looking to expand your market reach to new regions or countries, managing sales channels becomes even more critical. Local market conditions, regulations, and customer behaviours vary, and your sales channels need to adapt accordingly to penetrate and thrive in new markets.

So, study the market that you’re expanding to carefully and analyse the results your sales strategy brings. Based on those results, modify the strategy to drive even more sales from that region. Businesses that incorporate revenue growth management tools into their expansion efforts can make data-backed decisions that enhance profitability and reduce risk.

So, how do you go about optimising sales channels for revenue growth?

How to Optimise Sales Channels

1. Data-Driven InsightsUtilise advanced analytics to gain insights into the performance of each sales channel. Monitor subscription metrics such as sales volume, customer acquisition costs, and conversion rates. This data can help you identify which channels are most effective and where improvements are needed to ensure sustainable growth.

Use AI and ML powered tools with revenue growth management capabilities to further improve this analysis and get your sales channel optimisation right. It can help boost conversions and drive your profitable revenue growth.

2. Channel-Specific StrategiesTailor your efforts to each sales channel. Consider the platform, audience or consumer segments, and messaging that resonates best with customers in each channel.

Make sure your sales reps know which pricing strategies and messaging are most effective in specific channels. This alignment can improve results, enhance key capabilities, and support growth across all channels, driving overall business performance.

Revenue growth management plays a key role in determining which pricing models and promotional tactics yield the highest return on investment across different sales channels.

3. Omnichannel IntegrationOptimise sales by integrating multiple channels, creating a seamless experience for customers. Whether customers are interacting via a website, mobile app, social media, or email, a unified message increases conversion rates.

This approach allows customers to switch between channels effortlessly, maintaining context and preferences. Centralised management of these channels enables businesses to track promotion effectiveness and drive performance, especially across diverse consumer segments.

4. Performance-Based IncentivesIncentivize sales teams based on the performance of each channel. This approach motivates teams to prioritise high-performing channels and improve lagging ones. With a robust revenue growth management solution, you can track key subscription metrics per channel.

Rewarding performance based on metrics like customer acquisition and sales volume encourages teams to focus on driving sustainable growth through the most effective channels.

5. Customer Feedback LoopsRegularly gather and analyse feedback from customers in each sales channel. This data provides insights into what resonates with specific consumer segments and can guide adjustments in your RGM strategy.

By listening to customers, you can enhance business performance and build lasting relationships.

Implementing Revenue Growth Management Strategies

Now that you know the major factors that play a role in Revenue Growth Management, it’s time to look at how you can implement the various strategies that can drive your revenue growth up.

Data Analysis and Insights

Data forms the foundation of Revenue Growth Management. Without it, you’d be left directionless as you won’t know the performance of your Revenue Growth Management strategies like sales channels or pricing plans.

In fact, if you don’t collect and analyse data, you likely won’t be able to optimise your revenues.

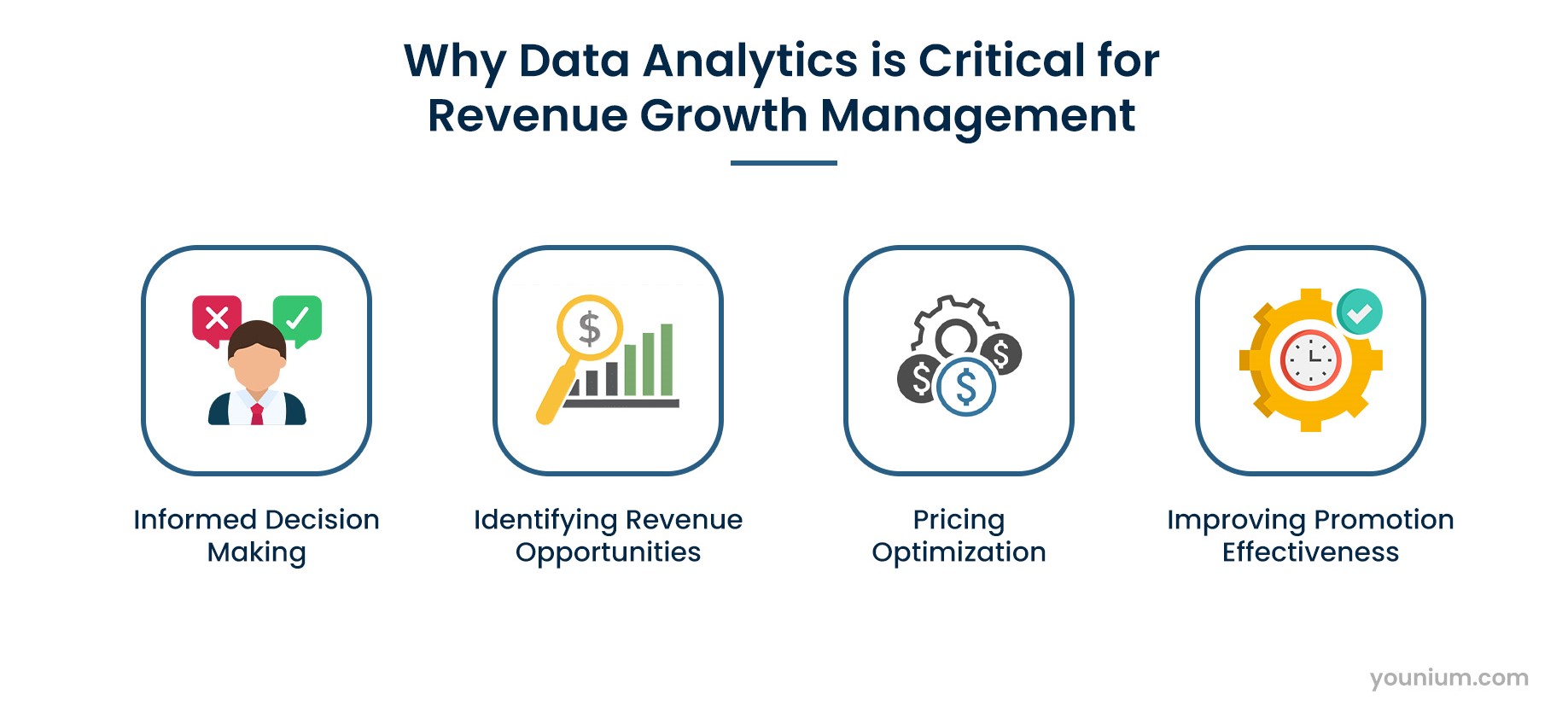

Why Data Analytics Matters in Revenue Growth Management

Here’s how data analytics helps you with Revenue Growth Management.

Data analysis empowers you to make informed decisions. By examining historical sales data, market trends, and consumer preferences, you can better align your strategies with what works best for your target audience. Additionally, forecasting using revenue growth management tools like Younium can help you find the best path ahead.

Such data-driven decisions can help you make an impact on your revenue as you’ll be better placed to improve your pricing, marketing, and sales strategies.

2. Identifying Revenue OpportunitiesThrough data analysis, you can uncover hidden revenue opportunities. This might include identifying underperforming products or high-potential customer segments that can be targeted for growth.

Diving deeper into your subscription business’s analytics can also help you uncover some crucial insights regarding your finances. By seeing churn, renewal, and subscription trends on Younium’s dashboard, you can spot new opportunities. A strong revenue growth management strategy helps you act on these insights to drive sustainable business expansion.

3. Pricing OptimizationData-driven pricing strategies are a key component of revenue growth management. Analysing pricing data, competitor pricing, and consumer behaviour helps in setting optimal price points to maximise revenue without compromising profitability.

Additionally, by understanding how different pricing plans perform, you can figure out which strategies will work best for your SaaS.

4. Improving Promotion EffectivenessYou can determine which campaigns generated the highest ROI, enabling you to allocate resources more efficiently. Additionally, you can predict future trends more accurately and preemptively change your strategies for them.

Tools and Methodologies for Data-Driven Revenue Growth Management

To effectively utilise data for Revenue Growth Management, you should leverage various precision RGM tools:

1. Data Analytics SoftwareAnalysing data, especially big data, is no mean deal. You need to first collect all that data and then make sense of it. That’s where the need to invest in a robust data analytics software arises. These platforms can help you sift through large data sets and analyse them.

Based on this analysis, you can come up with insights that can drive your future decisions. Tools like Tableau, Power BI, and Google Analytics can help you visualise and interpret data effectively. Similarly, you can use Younium for analysing your subscription, booking, and revenue metrics.

Younium also offers integration with business intelligence platforms which can help with data analytics. Alternatively, you can export data from Younium to analyse on third-party data analytics platforms.

2. Predictive AnalyticsBy leveraging the power of AI and ML, you can predict certain trends that could affect your revenues. That’s where predictive analytics comes into the picture. Predictive analytics algorithms use historical data to forecast future trends and customer behaviour. This enables proactive decision-making, such as anticipating demand fluctuations.

For instance, you can figure out if a certain season leads to more users for your SaaS. It helps you plan better for such demand peaks and you can accordingly get more server space for your SaaS. It also helps you with budgeting for any such variations in demand.

Similarly, you can predict how a particular strategy could affect your revenue. With Younium’s forecasting features, you can find the exact trajectory of your SaaS in terms of subscription revenue and churn. Using the insights from these forecasts, you can drive better revenue growth for your SaaS.

3. A/B TestingWhen you’re testing out different pricing plans or features for your SaaS, it makes sense to run A/B tests. These tests essentially help you understand which variation of your pricing or features works best for your SaaS.

You could even use A/B testing for various marketing and sales channels. These include emails, website layouts, landing pages, and more. The key here is to remember that A/B testing isn’t a set-and-forget method. Instead, it’s a continuous process and you should keep running these tests every few months to further improve your growth prospects.

Successful revenue growth management involves consistently testing and refining your strategies to maximise profitability.

4. Customer SegmentationData-driven insights can help you refine your customer list and split it into segments that you can use to target your customers with more laser-sharp personalized messaging.

And this doesn’t apply solely to marketing or sales. In fact, you can even customise the pricing for various customers. For instance, you could tailor the pricing of your SaaS for each country.

A CRM integration with your revenue growth management platform comes in handy for such personalized approaches. For instance, Younium offers integrations with CRMs like Dynamics 365 CE. It enables you to synchronise customers between both platforms. At the same time, all subscription and invoice data from Younium would be available in the CRM for targeted messaging.

5. Feedback and SurveysCollect feedback from customers through surveys and feedback forms. Such feedback helps you understand what you’re doing right and what needs changing—right from the end users’ mouths. It helps you understand consumer needs better.

By implementing the changes that they want, you can instantly improve your customer experience and meet their expectations. This is particularly helpful in preventing churn and improving your Net Recurring Revenue (NRR).

Additionally, feedback analysis plays a critical role in revenue growth management, helping businesses refine pricing strategies and optimise their revenue streams.

Developing a Revenue Growth Management Plan

Now that you know all about the importance of data analytics and insights, and how you can leverage them, let’s learn about creating a Revenue Growth Management plan.

But what exactly is a Revenue Growth Management plan?

In simple terms, it’s a roadmap that clearly outlines the steps you need to take to drive your revenue growth and take it to the next level. The strategy provides you with a clear direction that can help you reach your goals.

So, why is it important to have such a plan?

The Importance of a Revenue Growth Management Plan

- Alignment with Business Goals: A revenue growth management plan aligns your revenue growth strategy with broader business objectives. It ensures that every action taken supports the overarching mission of your SaaS business.

- Strategic Decision-Making: With a well-defined revenue growth management plan, you can make data-driven decisions on pricing, promotions, product development, and sales channel management. This prevents ad-hoc or inconsistent approaches.

- Resource Allocation: A revenue growth management plan helps you allocate resources efficiently. As your strategy will outline everything that needs to be done, you’ll be able to avoid a situation where you invest resources into plans that don’t bring results.

- Measurable Progress: Setting clear goals and key performance indicators (KPIs) like MRR, ARR, CMRR, NRR, churn rate, and more in your plan allows you to track your progress over time. This enables you to adapt and refine your strategies based on real-world results.

Steps to Create Your Revenue Growth Management Plan

Here are the steps you can take to create your revenue growth management plan.

Like every other strategy, you need to set goals for your revenue growth management plan before starting it. It’s only once you’ve got them figured out that you can start planning how to reach them. Additionally, you can determine your KPIs only based on your goals.

So, begin by clearly defining your revenue growth objectives. Are you aiming for a specific percentage increase in revenue? Do you want to expand into new markets or customer segments? Understanding your goals is essential.

2. Conduct Market ResearchConduct a comprehensive analysis of your market. Understand your competitors, customer demographics, purchasing behaviours, and emerging trends in the SaaS business. Collect as much data as possible for each of these factors that influence your market. It’ll help inform your Revenue Growth Management strategies and drive better results.

3. Do a SWOT AnalysisPerform a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to identify internal and external factors that can impact your revenue growth. Leverage your strengths and address weaknesses.

Expanding to new markets but aren’t able to charge in their local currency? That’s a weakness. With a Revenue Growth Management software platform like Younium, you can solve it.

Identify such weaknesses and see how you can fix it with your revenue growth management platform.

4. Get Segmentation RightSegment your consumer base into distinct groups based on factors such as demographics, behaviour, and preferences. Use the data you’ve collected on your existing customer and audience base for this.

Additionally, brainstorm and identify various segments in your audience based on parameters like product pricing, industry, and more. This allows you to tailor Revenue Growth Management strategies to each segment.

5. Strategy DevelopmentBased on your analysis and segmentation, develop specific Revenue Growth Management strategies. These may include pricing optimisation, targeted promotions, product enhancements, and sales channel adjustments.

Make sure you A/B test these strategies to ensure that you only double down on those that are driving real results like minimizing churn and growing market share through revenue growth.

When it comes to finances, make sure you automate routine and tedious tasks like sending out invoices, revenue recognition, and payment collection. It helps minimize errors and with a platform like Younium, you can easily track them all through the detailed reports it generates. It also ensures you stay compliant with ASC 606 and IFRS 15. By automating these operations, you also create a strong foundation for the execution of your strategies.

6. Resource AllocationDetermine the resources required to execute your Revenue Growth Management strategies. This includes budget allocation, personnel, technology, and any partnerships or collaborations.

Some of these resources, like budget, should also be taken into account before you start implementing your strategies as they will determine the scale at which you can go about it.

You must also select the right software solutions to track your metrics in advance. Determine which metrics need tracking and choose the solution based on them. Younium, for instance, can help you track all important subscription metrics.

7. Create Timeline and MilestonesCreate a timeline with milestones to track progress. Establish deadlines for the implementation of specific strategies and the achievement of revenue growth targets.

Doing so also helps you keep your team on the same page. It even enables you to track your team’s performance in adhering to the deadlines.

8. Continuous Monitoring and EvaluationThis is where those goals come into the picture all over again. You should continuously use the key performance indicators to measure where you stand in comparison to your goals. It can help you understand if you’re falling short or meeting them. Accordingly, you can plan on tweaking your strategies further to improve your revenue.

You can use a recurring billing and subscription management solution like Younium to track your subscription metrics and churn. Using the insights from this data, you can understand the impact of your Revenue Growth Management approach and accordingly tweak it.

Younium also tracks all subscription events for you, so you can see how they’ve impacted your subscription and revenue metrics. It enables you to find the right strategy to ensure revenue growth.

9. Establish Feedback LoopsEstablish feedback mechanisms to collect input from customers, sales teams, and other stakeholders. Use this to refine your strategies and adapt to changing market conditions.

This is where surveys and reviews come in handy. You can use onboarding, exit, and ongoing surveys to understand how your customers feel about your service. It can help you find issues that need to be addressed.

Similarly, you should look out for customer reviews on platforms like G2 and TrustPilot to see what customers are talking about your SaaS. It helps to monitor your social mentions too. By identifying the common issues mentioned there and acting upon them, you can improve your customer experience.

10. Documentation and CommunicationDocument your Revenue Growth Management plan comprehensively and communicate it to all relevant stakeholders within your organization. Ensure everyone understands their roles and responsibilities. It helps keep everyone on the same page and brings accountability too.

It’s the key to a successful implementation of all that you’ve planned.

Additionally, ensure that the Revenue Growth Management software platform you’ve chosen provides you with ample documentation related to subscriptions and business finances.

For instance, Younium provides rich transaction details, ASC 606 and IFRS 15 compliant revenue insights, and booking and subscription metrics. It also features a built-in reporting engine that enables you to create reports on any object. By analysing the reports, you can determine future steps to be taken to drive your revenue growth.

Younium also gives you the ability to create custom dashboards for your stakeholders on the platform. This way, you can give full transparency to them with accurate and updated data.

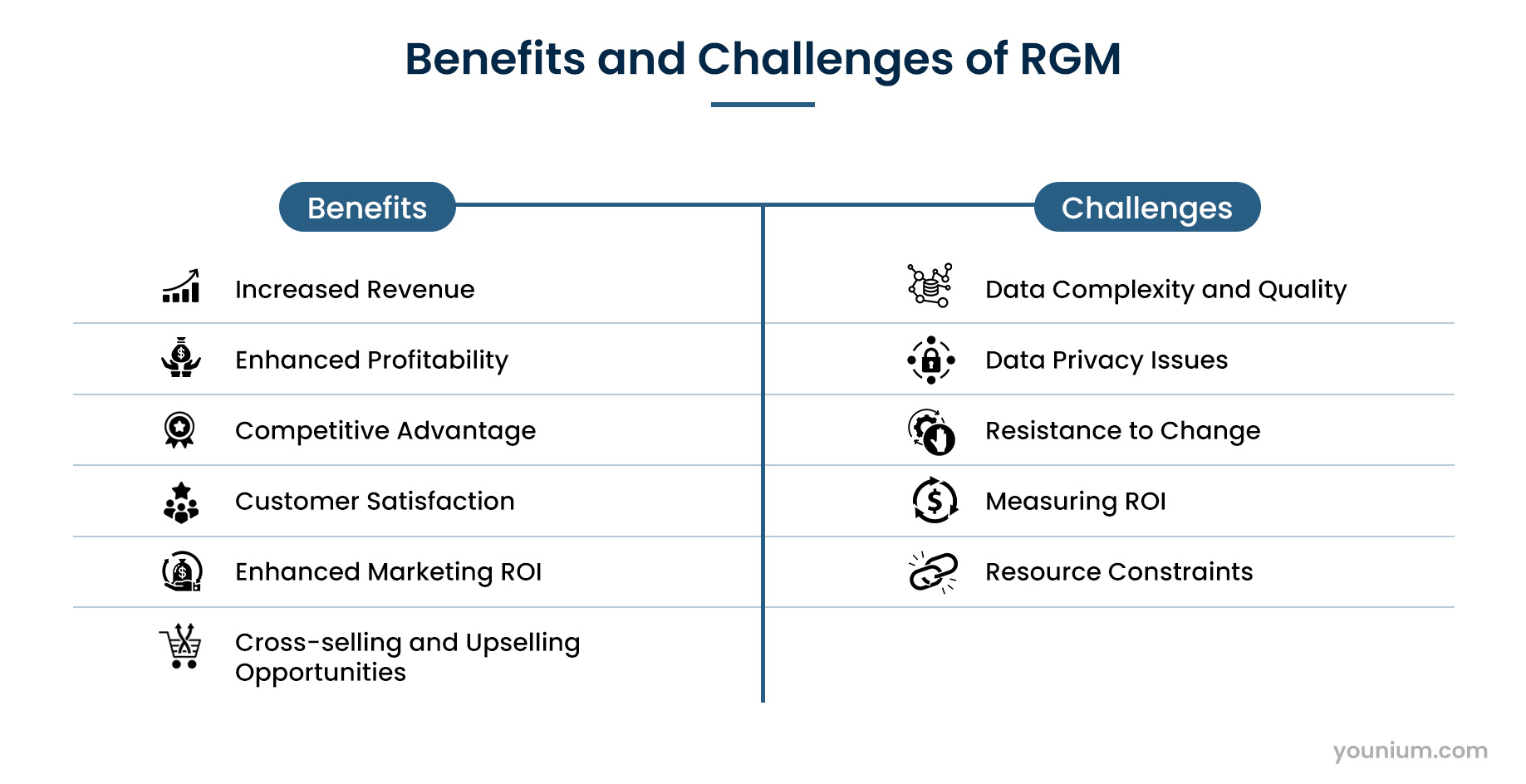

Benefits and Challenges of Revenue Growth Management

Well, so you now have a clear idea of how to go about creating your very own Revenue Growth Management plan. But before you go ahead and start making one, it’s important to take a look at the benefits and challenges of Revenue Growth Management so you can make an informed decision.

Benefits

Some of the advantages of implementing Revenue Growth Management include:

- Increased Revenue: The most apparent and immediate benefit of Revenue Growth Management is higher revenue. By optimising pricing, promotions, product offerings, and sales channels, you can generate greater revenue from existing and new customers.

- Enhanced Profitability: Revenue Growth Management doesn't focus solely on increasing revenue; it also emphasizes improving profitability by increasing revenue and cutting costs.

- Competitive Advantage: SaaS businesses that effectively implement Revenue Growth Management can respond quickly to market changes, customer preferences, and emerging trends. This gives you a fast-mover advantage. The right RGM solution gives you flexibility to identify and react to any changes or challenges.

- Customer Satisfaction: Revenue Growth Management enables you to tailor products, pricing, and marketing to specific customer segments. It helps enhance customer experience and boosts loyalty. By understanding exactly what clicks with your customers, you can provide customers with the features they like and reduce your churn dramatically.

- Enhanced Marketing ROI: With data-driven insights and personalized marketing campaigns, Revenue Growth Management drives better ROI from your marketing efforts.

- Cross-Selling and Upselling Opportunities: You can get deep customer insights with Younium to identify the right upsell and cross-sell opportunities for your business.

Challenges

Implementing Revenue Growth Management is easier said than done. There are several new challenges that you could face.

These include:

- Data Complexity and Quality: It can be difficult to get a 360-degree view of the data. You’d have to rely on the data you’ve collected, and that may not be sufficient enough. Additionally, this data may be difficult to analyse and might not give the right set of insights. That’s why you should choose a platform that collects all relevant data on your subscriptions to ensure high data quality.

- Data Privacy Issues: The data you collect on your audience or customers needs to be handled safely. You’d also have to abide by numerous country and state-specific data regulations. In fact, 94% of organizations are aware that their customers won’t buy from them if their data isn’t protected. So, make sure you choose an RGM platform that prioritises data safety and information security, like Younium.

- Resistance to Change: If your teams aren’t functioning in unison, you might find it challenging to implement revenue growth management well. Additionally, everyone in your team might not be open to a cultural shift to business practices. It’s thus important to educate your team about the advantages of RGM platforms so there’s less friction when it comes to adopting it.

- Measuring ROI: Determining the return on investment (ROI) of of RGM strategies can be challenging, especially when the impact of multiple factors on revenue is complex to isolate. So, make sure you use a platform like Younium that shows you the LTV/CAC ratio to help determine your ROI.

- Resource Constraints: Implementing revenue growth management strategies often requires investments in financial technology, data analytics talent, and training. As a small SaaS business, it could get challenging to compete in this area. You should choose an RGM platform that suits your budget to avoid this issue.

FAQs

1. What are the 5 levers of Revenue Growth Management?Some of the main levers or components of Revenue Growth Management are:

- Pricing of your products and services (Pack price architecture for CPG brands)

- Marketing and promotion management

- Sales channel optimisation

- Product optimisation

- Trade terms management (Used by CPG industry)

- Improving supply chain (for CPG industry)

Some of the biggest benefits of opting for Revenue Growth Management are:

- Increased revenue: It helps boost your revenues.

- Profitability enhancement: Enables you to cut your expenses and grow revenues, leading to higher profitability.

- Competitive advantage: Helps your SaaS adapt to new trends quickly, making it easy to get an advantage over competitors.

- Customer satisfaction: It helps you tailor your pricing, marketing, and product for your customers, leading to better satisfaction.

- Enhanced marketing ROI: Drives superior results from your marketing efforts, leading to better ROI.

- Cross-selling and upselling opportunities: Makes it easy to find the right products for cross-selling and upselling.

The end goal of Revenue Growth Management is to ensure steady consistent growth for a business. It helps achieve it by understanding and optimising the various factors that affect revenue growth, including the pricing, product, marketing, and sales. It uses data and analytical algorithms to fuel this growth.

4. How does Younium help with revenue growth management?Younium is an end-to-end B2B subscription management platform that helps with all aspects of revenue management. From helping you accurately recognize revenue to automatically generating consolidated invoices, it simplifies the entire process.

As your business grows, subscription revenue management becomes more difficult. Younium can scale with your business and handle complex billing and revenue recognition scenarios to simplify things for your finance team.

What’s more, is that it helps you comply with regulatory standards like ASC 606 and IFRS 15. It also calculates taxes and helps you comply with local tax regulations.

Overall, with Younium, you don’t need to worry about revenue and billing as it handles all the complexities associated with a subscription business.

5. What is the definition of Revenue Growth Management?In simple terms, Revenue Growth Management is the process of driving sustainable and profitable growth of your SaaS business by increasing your customer base, optimising pricing, marketing, and sales. You do this through a range of customer acquisition and retention strategies.

Conclusion

Revenue Growth Management is a powerful strategic approach that empowers your SaaS business to achieve consistent and sustainable revenue growth. What makes this approach stand out from the rest is the fact that it looks at the holistic optimisation of revenue through various factors including pricing, product, finances, and sales.

This healthy approach also ensures that your business consistently acquires new customers and retains existing ones by elevating their experience.

That said, it’s important to have a solid RGM plan in place before you start out. You must also carefully consider the various challenges that you might encounter in the smooth rollout of this strategy.

So, check where your business currently stands and implement Revenue Growth Management to take your revenues and profits to the next level.

And with a subscription management platform like Younium that offers automation features, you’ve got precise subscription and SaaS revenue data that can help with better billing and business decisions, leading to improved revenues. Get a demo of Younium today to understand how it helps supercharge your revenue growth.