Forecasting Subscription Revenue: How to Do It Right

Learn crucial tips for forecasting subscription revenue accurately. Get insights on accurate prediction methods, including key metrics like MRR and churn rate.

This post was last updated on February 16, 2024.

Jump to read

What is Subscription Revenue Forecasting?

Key Metrics for Forecasting Subscription Revenue

Best Approach to Forecasting Subscription Revenue

Factors to Consider While Forecasting Subscription Revenue

Common Pitfalls in Subscription Revenue Forecasting

FAQs

Wrapping Up

Forecasting subscription revenue is essential for B2B SaaS businesses — not only for raising funding, but also for managing cash flow, planning growth, and making informed strategic decisions.

However, building an accurate subscription revenue forecast can be challenging. Subscription-based business models introduce complexity through recurring billing, usage-based pricing, customer churn, upgrades, downgrades, and contract changes. Many SaaS companies struggle to account for these variables when predicting future revenue.

In this article, we explore best practices for forecasting subscription revenue, including the key metrics and factors that influence forecast accuracy. You’ll find practical, actionable insights to help you build reliable revenue forecasts and support sustainable growth.

Before diving into forecasting methods, it’s important to understand what subscription revenue forecasting is and why it plays such a critical role in SaaS finance.

What is Subscription Revenue Forecasting?

Subscription revenue forecasting is the process of estimating the recurring revenue a business expects to generate over a defined period — typically monthly, quarterly, or annually.

Accurate subscription revenue forecasts help SaaS companies:

-

plan budgets and allocate resources effectively

-

forecast cash flow and runway

-

support fundraising and investor reporting

-

anticipate growth and operational needs

For any subscription-based business, reliable revenue forecasting is a foundational component of long-term success.

Before discussing forecasting techniques, it’s essential to understand the core revenue metrics that underpin subscription revenue forecasts.

Key Metrics for Forecasting Subscription Revenue

Following are the metrics that will help you forecast the revenue for a subscription-based business.

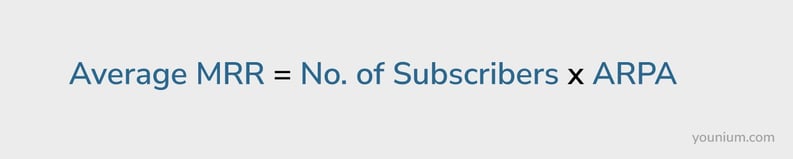

Average Monthly Recurring Revenue (Average MRR)

Average Monthly Recurring Revenue (MRR) represents the estimated recurring revenue a subscription business expects to generate in a given month.

It is typically calculated by multiplying the total number of active customers by the Average Revenue Per Account (ARPA). Average MRR provides a baseline for understanding predictable revenue and serves as a starting point for more advanced forecasting models.

For example, if your business has 30 customers and each of them pays $100 every month to leverage your services, your average MRR would be $100 * 30 = $3000.

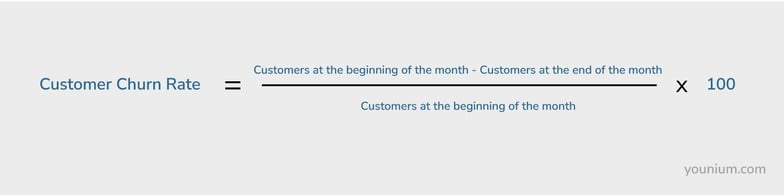

Customer Churn Rate (CCR)

The customer churn rate is an indicator of how many customers (customers) a business loses every month/year.

The customer churn rate is measured by dividing the no. of customers who unsubscribed during a period by the total no. of customers at the start of that period. Multiply by a hundred to arrive at a percentage.

However, while calculating the customer churn rate for forecasting subscription revenue, you need to predict future customer behavior.

To predict customer churn, you can use Younium’s intelligent solutions for sales and marketing. It can help you with forecasting subscription revenue and managing subscriptions.

Average Revenue Per Account (ARPA)

If you divide the revenue by the number of accounts, you get the Average Revenue Per Account (ARPA). ARPA is essential for forecasting subscription revenue as it gives you access to your business’s revenue-generating capability at the per-customer level.

You can calculate the average revenue per account for forecasting subscription revenue by dividing the total MRR by the number of active customers in a month.

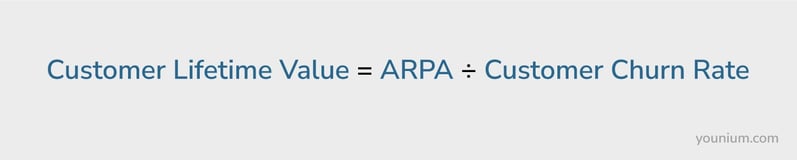

Customer Lifetime Value (CLV)

Customer lifetime value is a calculation of the total revenue a business would generate from a customer during their lifespan. To calculate your customers’ total lifetime value, you need to know your post-sign-up retention rate and monthly customer churn rate.

Now we know what subscription revenue forecasting is and its critical elements, let’s discuss the best approach to forecasting subscription revenue.

Best Approach to Forecasting Subscription Revenue

If you use a subscription management platform like Younium with built-in revenue forecasting, much of the work is automated. These platforms analyze historical subscription data to predict customer acquisition, churn, retention, and expansion — and then calculate expected future revenue with greater accuracy.

However, many SaaS companies still rely on spreadsheets to track subscription metrics. In that case, forecasting subscription revenue becomes a manual process that requires careful analysis and regular updates.

Below are four practical steps to help you forecast subscription revenue manually when using spreadsheets or basic tools.

1. Calculate Your Customer Base

The first thing you should do is prepare a continuity schedule for your customers. The customer base for each of your months/quarters will be “customers at the start of the period + new customers- subscription cancellations.”

In a typical subscription-based environment, you can consider three revenue streams to prepare a customer’s continuity schedule:

- Revenue from existing customers

- Revenue from new customers

- Revenue from future subscription renewals

Here’s an example of how to calculate your customer base:

| Month 1 | Month 2 | Month 3 | ||

| A | Customers (start of the month); (last month’s D) | 80 | 272 | 442 |

| B | New customers | 200 | 200 | 200 |

| C | Subscription cancellation | 8 | 30 | 60 |

| D | Customers (end of the month); (A+B-C) | 272 | 442 | 582 |

| E | Customer base for revenue (A+B) | 280 | 472 | 642 |

2. Multiply customer Base by ARPA

Once you have calculated the customer base, multiply it by the average revenue per account and you’ll get monthly subscription revenue. This is typically called the MRR (Monthly Recurring Revenue).

| Month 1 | Month 2 | Month 3 | ||

| A | Customers (start of the month); (last month’s D) | 80 | 272 | 442 |

| B | New customers | 200 | 200 | 200 |

| C | Subscription cancellation | 8 | 30 | 60 |

| D | Customers (end of the month); (A+B-C) | 272 | 442 | 582 |

| E | Customer base for revenue (A+B) | 280 | 472 | 642 |

| F | Average Revenue Per Account (ARPA) | $100 | $100 | $100 |

| G | Monthly Recurring Revenue (E x F) | $28000 | $47200 | $64200 |

The monthly or annual recurring revenue will act as the basis for the rest of the business strategies like sales, marketing, and financing.

This data that you record at the initial stages will also act as a baseline for future predictions. For starters, it can be used to calculate churn rate and determine average customer lifetime.

3. Calculate Churn Rate

Determining the churn rate is essential to the success of a subscription business. Using the data recorded during the first step, you can calculate your churn rate by dividing subscription cancellations by the customers at the start of the particular month.

| Month 1 | Month 2 | Month 3 | ||

| A | Customers (start of the month); (last month’s D) | 80 | 272 | 442 |

| B | New customers | 200 | 200 | 200 |

| C | Subscription cancellation | 8 | 30 | 60 |

| D | Customers (end of the month); (A+B-C) | 272 | 442 | 582 |

| E | Customer base for revenue (A+B) | 280 | 472 | 642 |

| F | Average Revenue Per Account (ARPA) | $100 | $100 | $100 |

| G | Monthly Recurring Revenue (E x F) | $28000 | $47200 | $64200 |

| H | Customer Churn Rate [100 x (C ÷ A)] | 10% | 11% | 14% |

| I | Projected Customer Lifetime in Months (1 ÷ H) | 10 | 9.09 | 7.14 |

The customer churn rate can be used to calculate the projected customer lifetime. To determine that, you just have to divide 1 with the value of customer churn. In the above illustration, the projected customer lifetime for the first month is calculated as

1 ÷ 0.10 = 10 months.

4. Determine Average Customer Lifetime Value and Forecast Annual Recurring Revenue

When you have the average customer lifespan projects, you can use them to calculate the Average Customer Lifetime Value (ACLV). The ACLV can be calculated with a basic formula as

ACLV = Projected lifetime x ARPA

Or

ACLV = ARPA ÷ Churn Rate

Moreover, you can multiply your monthly revenue (MRR) by 12 to get the Annual Recurring Revenue forecast.

This is how we can calculate our Average Customer Lifetime Value and Annual Recurring Revenue in our hypothetical example.

| Month 1 | Month 2 | Month 3 | ||

| A | Customers (start of the month); (last month’s D) | 80 | 272 | 442 |

| B | New customers | 200 | 200 | 200 |

| C | Subscription cancellation | 8 | 30 | 60 |

| D | Customers (end of the month); (A+B-C) | 272 | 442 | 582 |

| E | Customer base for revenue (A+B) | 280 | 472 | 642 |

| F | Average Revenue Per Account (ARPA) | $100 | $100 | $100 |

| G | Monthly Recurring Revenue (E x F) | $28000 | $47200 | $64200 |

| H | Customer Churn Rate [100 x (C ÷ A)] | 10% | 11% | 14% |

| I | Projected Customer Lifetime in Months (1 ÷ H) | 10 | 9.09 | 7.14 |

| J | ACLV (I x F) or (F ÷ H) | $1,000 | $909 | $714 |

| K | ARR (G x 12) | $336,000 | $566,400 | $770,400 |

Factors to Consider While Forecasting Subscription Revenue

While forecasting subscription revenue, you need to consider the following factors to ensure effectiveness.

1. Analyze Recent and Current Strategic Changes

Although your historical data is a great baseline for forecasting recurring revenue, you cannot undermine the recent strategic changes since you’ve collected the data.

Think of the recent product/service introductions, new marketing activities, and sales promotions strategies that can impact your forecast.

For example, bundled services can improve your customer acquisition rate, whereas raising subscription prices might increase your customer lifetime value.

Hence, it’s important to consider the recent strategic changes while forecasting subscription revenue.

2. Leverage Sales Pipeline

Sales pipelines are the most reliable indicator of how many customers you might have in the upcoming months or years.

You can find all the required information in your sales department's sales projection reports for every month or quarter. Gauge how many leads your sales teams are nurturing and what their projections are for the period.

3. Analyze Customer Behavior

For forecasting subscription revenue, it is essential to analyze the current user behavior. The churn and renewal rates are very diversified across the customers’ life cycles. But looking at each customer’s recent behavior, you can predict their churn likelihood.

For example, if some users haven’t logged into your application for a month, they’re less likely to renew their subscriptions. Moreover, the churn rate will be higher during the first-month trial period and a few months after that.

The best approach to calculate customer retention is cohort analysis. By grouping the customers into cohorts as per their persona and lifespan, you can predict their likelihood of renewing their subscriptions.

Common Pitfalls in Subscription Revenue Forecasting

While forecasting subscription revenue is crucial for predictable revenue and cash flow, many businesses fall into common traps that can lead to inaccurate forecasts. Here are some pitfalls to avoid and tips for more accurate subscription revenue forecasting.

1. Overreliance on Historical Data

While past performance is important, it shouldn't be the sole basis for your forecast.

The subscription-based model is dynamic, and market trends, competitor actions, and customer preferences often shift rapidly. Always update your forecasts based on current data to better reflect recognized revenue.

2. Ignoring External Market Factors

Failing to consider broader economic conditions, competitor actions, or industry shifts can skew your forecast.

Regularly analyze market trends and incorporate insights from the broader market environment when forecasting subscription revenue.

3. Neglecting Seasonality and Product Lifecycle Stages

Many subscription-based models experience seasonal fluctuations.

Ignoring these patterns or your product’s lifecycle negatively impacts customer behavior. In fact, it can lead to overly optimistic or pessimistic forecasts and large variations in cash flow.

However, using cohort analysis to identify seasonal patterns in existing customers’ behavior can help you create a more predictable revenue stream.

4. Misinterpreting or Misusing Metrics

Metrics like monthly growth, customer churn, or recognized revenue can be misleading if not properly understood or applied. Misusing them can distort how much revenue you expect to generate.

Therefore, ensure that cross-functional teams — sales, finance, and marketing — are involved to provide a more balanced perspective on your sales pipeline and revenue forecasts.

FAQs

1. What are subscription revenues?Subscription revenue refers to the recurring income a business earns from customers who pay a subscription fee on a regular basis — such as monthly or annually.

Because subscription fees are charged repeatedly over a defined period, subscription revenue provides predictable and ongoing cash inflows. This makes it a core metric for SaaS and other subscription-based businesses when planning growth and forecasting revenue.

2. How do you calculate the total revenue forecast?A basic total revenue forecast for a subscription business can be calculated using the following formula:

(Customers at the start of the period + New customers) × Subscription fee per customer

This calculation provides a high-level estimate of expected revenue for a given month. For more accurate forecasting, SaaS companies often refine this model by factoring in churn, upgrades, downgrades, usage-based charges, and expansion revenue.

To forecast subscription revenue, you need two core inputs:

-

an estimate of your future customer base for a given period

-

the average revenue per customer (ARPA or ARPU)

Once you have these values, you can calculate your forecast using the following formula:

Subscription Revenue Forecast = Estimated Customer Base × Average Revenue Per Customer

This approach provides a foundational forecast. More advanced models often include additional factors such as churn, expansion revenue, usage-based charges, and contract changes.

Alternatively, you can use a subscription management platform like Younium to avoid manual calculations altogether. Younium automatically tracks key revenue metrics such as MRR and ARR, which form the basis of accurate revenue forecasting.

Younium’s reporting engine allows finance teams to create custom reports with the exact metrics they need, analyze trends over time, and generate actionable insights — helping businesses forecast revenue with greater accuracy and confidence.

Subscription revenue is the recurring price customers pay to hire your services. Hence, it’s an income for an organization, and even if it is yet to be received from the future billing cycles, it can be considered an asset as shown under the assets section of the Balance Sheet.

5. How should subscription revenue be recognized?The monthly or annual subscription revenues should be recognized on an accrual basis, which means that the revenue is recorded in the books when it’s earned instead of when it’s received.

6. What software can help with forecasting subscription revenue more accurately?

Accurate subscription revenue forecasting requires real-time access to subscription data, revenue metrics, and customer behavior. Many SaaS companies struggle to achieve this using spreadsheets or disconnected systems.

Subscription management platforms like Younium centralize billing, customer data, and revenue metrics in one system. By automatically tracking MRR, ARR, churn, expansion, and contract changes, Younium enables finance teams to build more reliable forecasts without manual reconciliation.

With customizable reporting and real-time dashboards, Younium helps SaaS businesses move from reactive forecasting to proactive, data-driven financial planning.

Wrapping Up

We’ve discussed the key metrics and ways for forecasting subscription revenue for SaaS companies. Calculating the future customer count and revenue streams is not difficult if you have a subscription revenue model in place.

You can read our recent blog on how to create a subscription revenue model if you need help.

Subscription management software supports you and your team with forecasting subscription revenue, head over to our subscription insights to learn more about how it works for B2B businesses. Reach out to our experts to understand more about how Younium supports B2B companies or to talk about your business needs.