7 Essential Subscription Business Metrics To Track in 2025

Track the right subscription business metrics in 2025. Learn the 7 essential metrics you should monitor to optimize and scale your subscription business.

Jump to read

Which subscription business metrics should you track?

What are Subscription Business Metrics?

7 Subscription Business Metrics to Track

FAQs

Which Subscription Business Metrics Suit You Best?

A common misconception about subscription businesses is that success hinges solely on the customers acquired.

While gaining subscribers is important, it’s far from the full picture. Many companies focus heavily on customer acquisition but overlook other critical subscription business metrics that drive sustainable growth.

The truth is, your ability to thrive in the subscription space depends just as much on tracking and optimizing the right metrics as it does on bringing in new customers.

Subscription business metrics offer deep insights into your company’s performance, helping you understand customer behavior, find areas for improvement, and identify opportunities to maximize revenue.

In this post, we'll examine seven key metrics you should track if you have a subscription-based business model.

Which subscription business metrics should you track?

To measure the performance of a subscription business, you need to look for subscription business metrics beyond revenue.

This is because subscription businesses focus more on the retention of their clients as opposed to client acquisition. This way, the nature of their revenue is recurrent, sustainable, and to an extent, predictable.

This goes to show just how important it is to keep tabs on subscription business metrics, to ensure a steady flow of revenue.

In this post, you’ll learn about 7 subscription business metrics that you should track. But first, let’s understand what subscription business metrics are and why they matter.

What are Subscription Business Metrics?

Every business has its key performance indicators. When it comes to subscription businesses, performance is gauged using some quantifiable metrics commonly known as subscription business metrics.

There are many subscription business metrics that you can track and every business can choose to focus on different metrics.

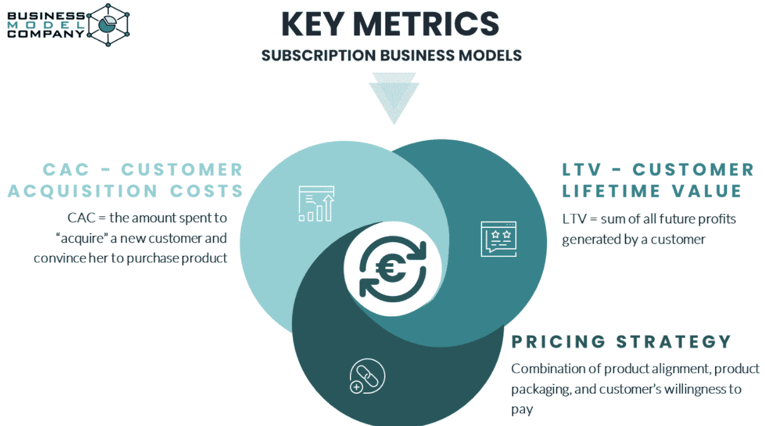

Here’s an example of the three key subscription business metrics that this company deems important.

Image via Business Model Company

These metrics help analyze your subscription rates, retention rates, and revenue earned.

It's important to choose the right subscription business metrics instead of getting lost in numbers. The subscription business metrics you choose should be aligned with your business goals.

But why is it important to track your subscription business metrics?

Here are a few reasons:

- They help you easily procure SaaS funding and win over potential investors.

- They track the success of new features or price models.

- If you report the right metrics it’ll drive your decisions based on facts.

- Using these subscription business metrics, you can benchmark your performance against competitors.

- They highlight shortcomings in your subscription business model and strategy.

With the information provided by these subscription business metrics, you can easily make future projections to drive your business toward success.

7 Subscription Business Metrics to Track

There are numerous metrics a business could use to track its performance. But only a few that highlight major aspects of a business are important.

Here are the most essential subscription business metrics you should consider:

1. Monthly Recurring Revenue (MRR)

MRR refers to the total revenue a business receives per month from various subscriptions.

It’s one of the most important metrics for any subscription business. This is because it shows the total monthly amount of revenue received from active subscriptions. It’s the most common KPI used in recurring businesses.

You get your MRR by multiplying your total number of customers with their monthly subscription rates.

This goes for annual, quarterly, and semiannual subscription plans as well. In such cases, you’ll find the monthly rate by dividing the total rate by the number of months.

Apart from MRR, you can also track other monthly numbers, such as new accounts, upsells, downsells, and churn.

For instance, if there are new customers, upgrades to premium packages, or downgrades, you may choose to compute Net MRR.

This would mean analyzing these computations differently from subscriptions that have existed throughout the month. This provides even more nuanced results.

Certain charges and items are excluded when calculating monthly recurring revenue. These include charges such as:

- Set-up fees

- Suspended subscriptions

- One-time activation fees

To effectively calculate MRR, use a good B2B subscription management solution to track SaaS metrics.

A good tool like Younium can automate data collection and analysis, providing detailed reports and insights to help you streamline your financial processes and optimize your performance.

2. Annual Recurring Revenue (ARR)

This subscription business metric analyzes your business’s recurring revenue for a year. Here, you take your monthly recurring rate and multiply it by 12.

If your subscription terms are annual, this is the best metric to measure rather than MRR. ARR is calculated by adding up each annual fee coming from the subscriptions then multiplying your annual rate by the number of subscribers.

You should also deduct freemiums to exclude months where payments were not requested.

Annual recurring revenue is important as it helps track your annual performance trends. These are especially useful when setting a business’s long-term goals.

It gives you ample data to make accurate financial projections.

With annual recurring rates, you can determine what strategies work better in boosting your business’s performance.

Such changes may include:

- Increasing subscription rates: You’ll know if you can charge more without increasing your churn rates. You’ll also learn how to do it right, depending on which packages performed best over the years.

- Eliminating unlimited packages: You can decide to charge more for more service offerings, instead of offering unlimited packages. This includes introducing a higher-priced package, if needed.

- Redirect resources to upsells and cross-sells: ARR helps you make decisions on whether to focus on revenue growth by client retention rather than acquisition.

With data from annual recurring revenue, your long-term decision-making process becomes clearer.

3. Churn Rate

Every subscription business wants a low churn rate—the rate at which customers terminate their subscriptions. This makes it one of the most important subscription business metrics there are.

A high churn rate reflects negatively on your subscription business and is often a sign that some changes are required to avoid losing customers.

According to Statista, the subscription businesses across different regions witnessed an increase in churn rates in 2023.

Image via Statista

According to this, 49% of US-based subscription commerce companies experienced an increase in customer churn in 2023.

You’d notice that for some businesses like cable and general retail the rates are really high.

So how high is too high?

Churn rates between 5% and 7% are considered manageable. Anything above that needs immediate action.

These rates are computed on a monthly, quarterly, semiannual, or annual basis. For the most effective churn rates, monthly calculations are encouraged.

To calculate that, you take the number of customers lost divided by the total number of customers at the beginning of the period. You then multiply the result by 100 to get the percentage.

You can factor in more elements into this metric, such as the period the subscriptions lasted before they were terminated. This improves the accuracy of your results.

Churn rates are important because they help you discern why your customers are leaving and try to make changes. This helps you take action to try and retain your customers.

Some factors that can lead to high churn rates are:

- Focusing on the wrong audience

- Your competitors offering better services

- Failed payment methods

- Unsatisfactory customer support

Once you identify the cause of your rising churn rates, you can take some steps to reduce it. Such actions may include:

- Checking in with clients by sending personalized emails and messages.

- Creating mobile-friendly subscriptions.

- Identifying dormant customers or those highly likely to leave and engage them.

- Asking customers their reason for ending their subscription. This could be the final step before they terminate their subscription. This helps avoid future churns.

Here’s an example of a form by Userpilot for collecting the reasons for ending a subscription:

Image via Userpilot

Beyond gathering responses from subscribers on their reason for canceling their subscription, Userpilot also requests input from subscribers on how to improve their services. It also gives them an incentive to keep their subscription.

Image via Userpilot

Another aspect of the churn rate that each business needs to compute is the revenue churn rate.

Besides monitoring the rate at which users unsubscribe, it’s also important to know the exact financial implications of it.

Revenue churn calculates how much revenue is lost to subscription terminations and downgrades.

4. Average Revenue Per Account (ARPA)

This is one of the subscription business metrics that monitor each user account’s monetary contribution to your business.

It’s a more specific way of analyzing revenue compared to the monthly recurring revenue, especially for tiered subscriptions.

This is because you can analyze ARPA based on every package for more specific numbers.

When calculating ARPA, you take your total monthly recurring revenue and divide it by your total number of subscribers. This includes your freemium subscribers if any.

ARPA helps determine how much of your subscriptions come from expensive packages versus cheaper ones.

For instance, an upward movement in your ARPA may indicate an increase in your premium subscriptions.

Similarly, a downward trend may indicate the opposite or even an increase in cheaper subscriptions.

This metric also helps determine if the revenue generated by your paid subscriptions can sustain your free plans, if any, to lead to sustainable growth.

Or if your free plans turn into enough paid subscriptions to make them sustainable. ARPA is a suitable metric for tiered subscriptions like the one shown below:

Image via Zendesk

ARPU is typically a metric most commonly used by B2C companies as the user is the buyer. In the B2B world we mainly speak about ARPA which is the average revenue per account which is the same principle but assumes the buyer is a company.

5. Customer Acquisition Cost (CAC)

Although not an exclusive subscription business metric, CAC indicates how well you budget your resources.

Your customer acquisition cost should be as low as possible. It should ideally be much lower than your customer’s lifetime value. Acquiring new customers should be profitable.

To get your CAC, you need to take the total sales and marketing costs directed towards customer acquisition. You then divide this value by the total number of new customers for a period.

When analyzing your customer acquisition costs, you need to do it through specific marketing channels.

For instance, separate email marketing costs from costs directed towards social media marketing. Similarly, separate the clients you acquire through each channel when calculating your CAC.

CAC also helps determine the effectiveness of each method of marketing you use. It helps manage sales and marketing efforts better.

You should always strive to keep your marketing costs at a minimum. How do you do that?

Here’s how.

- Ensure that you’re targeting the right market.

- Study your competitors and fill their marketing gaps.

- Make sure you communicate your products’ USPs clearly to your audience.

- Ensure your subscription process is easy to understand and execute. This includes streamlining your subscription billing methods as well.

6. Customer Lifetime Value (CLV)

This may be the last point discussed, but it’s easily one of the most important subscription business metrics.

Customer lifetime value is the total revenue each client would bring in over the lifetime of their subscription. This could be a month, a year, or longer.

The amount of revenue each client generates over the period of their association with your business should exceed the cost incurred in acquiring them and providing the service.

As such, this metric analyzes three other subscription business metrics including:

- Average return per user

- Client acquisition cost

- Customer churn rate

Here’s how Customer Lifetime Value is calculated:

Image via CommentSold

A low customer lifetime value may be due to:

- High churn rates.

- Low renewal rates

- Other factors that may require bigger changes in the company, for instance, a need to change the marketing strategy

Once you have your CLV, you can decide how much to spend on client acquisition. This will help reduce unnecessary costs.

CLV also helps you pick out your most valuable customers. This information can help you retain these existing customers and focus on acquiring similar new customers.

You can also use your CLV to find out why your high-value clients love your product or service. It may be how your product works, the need it fulfills, or how it compares to other similar products.

You can use that as a selling point for acquiring customers that are more profitable.

7. Net Promoter Score (NPS)

NPS is an important SaaS analytics metric that measures customer satisfaction and loyalty. It gauges how likely your customers are to recommend your service to others.

You can calculate NPS by sending a survey to ask customers about their chances of recommending your business to others. Give them a 10-point scale from unlikely to extremely likely.

Based on the ratings, categorize the customers into three groups:

- Promoters (ratings 9-10): Loyal customers who are enthusiastic about your brand and likely to refer others.

- Passives (ratings 7-8): Satisfied customers who may still consider switching to competitors.

- Detractors (ratings 0-6): Unsatisfied customers who not only switch to competitors but may damage your brand’s reputation.

To calculate your NPS, subtract the share of Detractors from the share of Promoters. The result is a score that ranges from -100 to +100.

Image via BowNow

A high NPS indicates that your customers are happy and willing to recommend your business to others. This suggests a strong product-market fit, effective customer service, and reduced churn rates.

Conversely, a low NPS signals that improvements are needed, whether in your product, customer support, or overall service experience.

FAQs

1. How do you measure the performance of a subscription business?

You can track key subscription business metrics to measure your business performance. Some important metrics you can consider include:

- Monthly Recurring Revenue (MRR)

- Annual Recurring Revenue (ARR)

- Churn Rate

- Average Revenue Per Account (ARPA)

- Customer Acquisition Cost (CAC)

- Customer Lifetime Value (CLV)

Using a subscription management solution Younium can simplify the process of tracking these metrics. Younium can help you track all important subscription metrics and provide detailed reports that you can use to gain valuable insights into your business performance, churn, and more.

2. How do you calculate average subscription revenue?You can calculate subscription revenue either monthly, annually, or per user. For a subscription business, measuring the recurring revenue (monthly or annual) makes more sense than just looking at the total revenue figure for a period.

To calculate subscription revenue simply multiply the number of subscribers by the average revenue per subscriber.

3. How do you evaluate a subscription business model?A subscription business model can be evaluated based on:

- The revenue generated

- Clients retained

- Clients acquired

- Subscriptions lost

The subscription metrics mentioned in this post also help with that.

4. What metrics do Saas and subscription-based companies use to evaluate their success?Common subscription business metrics include:

- Monthly recurring revenue

- Annual recurring revenue

- CMRR/ACV - Value of the revenue coming from the subscription booking

- Churn rate

- The average monthly revenue per account

- Customer acquisition cost

- Customer lifetime value

Use a subscription management platform like Younium to track all these metrics and get customized reports.

5. What is the most important SaaS metric?The most important subscription business metric depends on your business and your discipline within the business. A company’s North Star metric is its most important metric as it’s specific to the business’ long term success.

A North Star metric is one that tracks revenue conversions, measures a business’ progress and the value of its customers.

Which Subscription Business Metrics Suit You Best?

Of all the subscription business metrics listed above, there have to be a few that would best track your business’s performance.

Constantly tracking your subscription business metrics is the way to ensure your business thrives.

With the right subscription software, you can manage all your data, including billing information and analytics, from a single platform. With organized information, you can easily track your subscription business metrics. Feel free to contact Younium to request a free demo.

So, choose the right subscription business metrics and start tracking your performance accurately. All the best!